Policy

Under the Interjurisdictional Agreement on Workers’ Compensation (IJA), employers pro-rate their insurable earnings so that each Canadian Board only receives premiums for the work performed in that Board’s jurisdiction.

For employers whose home jurisdiction is Ontario, once an Ontario worker’s total gross earnings from all jurisdictions exceeds the Ontario maximum insurable earnings ceiling, the employer pro-rates the Ontario maximum in accordance with formulae set out in the IJA. This is done to determine the amount the employer can consider non-insurable earnings for the purpose of premium payment in Ontario on that worker’s earnings.

NOTE

Under the IJA, interjurisdictional trucking, pilot cars, courier, and bus employers may elect to participate in the Alternative Assessment Procedure (AAP). The AAP gives trucking, pilot cars, courier, and bus employers the option to report and pay premiums to one Canadian workers’ compensation board for those workers who meet the eligibility requirement. For details on the AAP, see 14-02-13, Alternative Assessment Procedure for Interjurisdictional Trucking & Transport Industry.

Purpose

The purpose of this policy is to describe the calculation of the portion of insurable earnings employers are required to report to the WSIB under the terms of the IJA.

Guidelines

General

The IJA applies to employers insured under Schedule 1 in Ontario (the home jurisdiction) and its collective liability equivalent in other Canadian jurisdictions (the work jurisdiction(s)). For details, see 15-01-11, Interjurisdictional Agreement.

Reporting earnings and paying premiums under the IJA

The IJA ensures that employers do not have to pay duplicate assessments for workers who perform work in more than one Canadian jurisdiction. Premium payments are levied according to the policies of the work jurisdiction at the premium rate for the industry in which the employer’s operations are classified.

An Ontario-based employer is responsible for contacting other Canadian jurisdictions in which the worker works to find out the details about calculating insurable earnings (and premium payments) for the portion of work performed outside Ontario.

Example

The Ontario employer of a worker who is working temporarily in Alberta contacts the Alberta Board and is told to report the worker’s earnings in Alberta. The employer reports the worker's earnings for work performed in Alberta (and pays premiums) to the Alberta Board, and does not report those same earnings, or pay premiums based on those earnings to the WSIB.

The following guidelines detail calculations when Ontario is the employer’s home jurisdiction.

Total gross earnings less than the maximum

Where a worker’s total gross earnings in all Canadian jurisdictions do not exceed Ontario’s maximum insurable earnings ceiling, Ontario premiums are levied on the full amount of the worker’s earnings for work performed in Ontario.

Example

The maximum insurable earnings in Ontario for a given year are $85,200 (2015). The worker earns $60,000 in Ontario, and $20,000 while working temporarily in Manitoba that same calendar year. The employer reports $20,000 in earnings to the Manitoba Board according to the Manitoba Board’s policies on reporting requirements for out-of-province employers and workers. The worker’s total gross earnings from all Canadian jurisdictions ($80,000) does not exceed Ontario’s maximum of $85,200 for the calendar year. Therefore, the full amount of the worker’s earnings for work performed in Ontario ($60,000) is insurable in Ontario.

Total gross earnings exceed the maximum

Where a worker’s total gross earnings in all Canadian jurisdictions exceeds the Ontario annual maximum, the Ontario maximum is pro-rated according to one of the formulae set out in the IJA in order to determine the amount the employer can consider non-insurable earnings in Ontario for that worker. For Ontario employers, pro-ration based on earnings applies to all industries except drivers in the transportation industry. For drivers in this industry, the pro-ration is based on mileage.

Under both methods, the pro-rated annual maximum becomes the annual insurable earnings for the worker in Ontario. If the gross insurable earnings already reported to Ontario for that worker is greater than the pro-rated annual maximum, the difference between the two amounts can be deducted as non-insurable earnings.

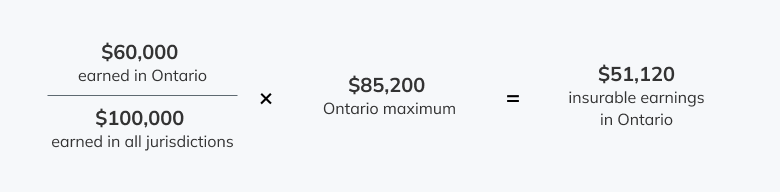

The earnings-based formula is

Example

The maximum insurable earnings in Ontario for a given year are $85,200 (2015). The worker earns $60,000 in Ontario, and $40,000 while working temporarily in British Columbia that same calendar year. The worker’s total gross earnings from all Canadian jurisdictions ($100,000) exceeds Ontario’s maximum of $84,100 for the calendar year. Therefore, a portion of the worker’s total gross earnings ($100,000) as calculated below using the earnings-based formula is insurable in Ontario.

Since the employer has already reported the $60,000 gross earnings in Ontario, the employer can deduct ($60,000 - $51,120)= $8,880 as non-insurable earnings for that worker.

NOTE

The employer may also be eligible for a pro-ration of the earnings reported to the British Columbia Board according to the applicable policy of the British Columbia Board.

The mileage-based formula is

For details about the mileage-based formula in the trucking and courier industries, see 14-02-09, Insurable Earnings - Drivers in the Transportation Industry.

Exceptions to the IJA

If the industry or the Ontario worker is not insured in the jurisdiction where the work is being done, the Ontario employer pays premiums to the WSIB (the home jurisdiction), on the worker’s total earnings, subject to the annual maximum insurable earnings.

Out-of-province employers

An out-of-province employer with a worker who has a substantial connection with Ontario must report and pay premiums on that worker’s earnings to the WSIB for the work performed in Ontario. For details about how a substantial connection is established, see 12-04-12, Non-Resident Workers.

NOTE

If the out-of-province employer is a trucking, pilot car, courier or bus employer, then the employer only pays premiums to the WSIB with respect to that driver’s earnings if the driver picks up or delivers goods in Ontario.

Application date

This policy applies to decisions made on or after June 1, 2023, with respect to the calculation of premiums based on earnings earned from January 1, 2018.

Document history

This document replaces 14-02-12, dated January 2, 2018.

This policy was previously published as:

14-02-12 dated January 1, 2015

14-02-12 dated January 2, 2014

14-02-12 dated October 12, 2004

14-02-12 dated July 19, 2004.

References

Legislative authority

Workplace Safety and Insurance Act, 1997, as amended

Sections 54, 78, 87, 88, 159,160

Minute

Administrative

#1, May 25, 2023, page 616