Businesses covered by our workplace injury and illness insurance pay a rate that reflects their industry and experience.

Your premium rate is set using a two-step approach

Step 1: Business classification

Your business is assigned one or more six-digit industry classification codes under the North American Industry Classifications System (NAICS) class/subclass based on your business activities.

If your business has more than one business activity, we’ll use your primary business activity – the business activity with the highest amount of insurable earnings.

Each class/subclass has a different premium rate, reflecting the average risk of the business activities of the industries insured in that group. You can use our Employer Classification Manual to review the descriptions for each NAICS code. You can also see what classes/subclasses businesses have mapped to based on their predominant rate group under the old system using our predominant mapping chart.

You can find your NAICS code, class/subclass and premium rate is printed on your premium rate summary statement.

Step 2: Determining your individual rate

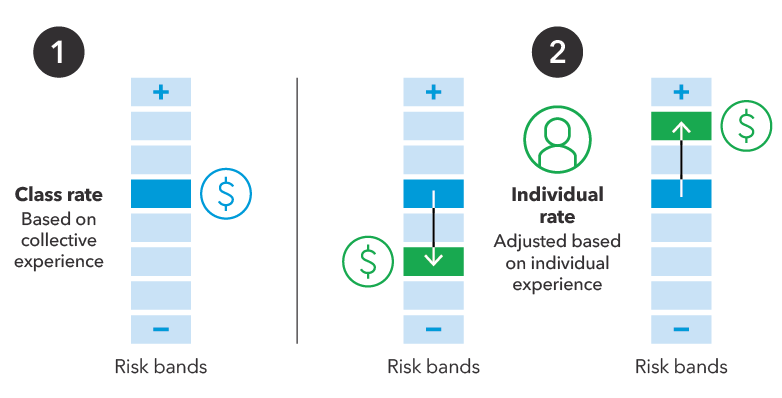

Class rate

Your class rate is based on the shared risk of all the businesses that do the same type of work in your class. If the class rate changes as a result of the overall claims experience of that class, it will impact the other risk band rates within that class.

Risk band

Your business is assigned to a risk band that best represents your risk in relation to other businesses in your class. The risk band rate includes rate adjustments based on your individual experience.

Businesses that fall under the same risk band rate have similar risk profiles and will pay the same rate. The differences between each risk band rate is approximately five per cent.

We'll use your insurable earnings, claims costs and the number of allowed claims, over a six-year period to set your premium rates. For new businesses with less than one year of experience, your premium rate will be the class rate.

We sometimes audit businesses to ensure accurate payroll reporting, proper class/subclass classification, and to evaluate whether they're complying with their legislative requirements with respect to reporting workplace injuries and illnesses. Read more about business audits for more information.

Projected premium rate

Your projected premium rate provides the future direction, up or down, that your rate is headed if there's no change in your individual and class experience from year-to-year. Knowing this rate information gives you time to prepare and adjust for future rate changes.

Predictability

A business's predictability is a key component of determining the projected premium rate. It is a measure of how much we can rely on your past claims experience and insurable earnings to predict future outcomes. Some businesses have a low predictability while other have a high predictability.

Low predictability means a business's insurable earnings and the number of allowed claims are quite low. In this case, your claims experience would not have a significant impact on your rate. Instead, the rates of your class will have more influence on your premium rate, which protects against volatility and the dramatic effect one claim could have on your rate.

High predictability means a business has a higher number of allowed claims and larger insurable earnings. In this case, volatility is not as high, as each single claim likely will not have a significant impact on your rate.

Questions?

Send us a message about your premium rate online anywhere, anytime.

Updated: