Key Topics

Objective

One prospective rate setting approach for all employers, acting as an early warning for employers with premium rate implications, supporting their efforts aimed at improving health and safety outcomes.

Alternatives for Further Discussion

- The level of actuarial predictability for individual employers, including implications for small employers and the treatment of new employers;

- The use of risk bands vs an individualized rate for each employer;

- The appropriate number, increments, size, relativity and movement of risk bands;

- Premium rate limits that act as a threshold for surcharging an employer, or further collective liability at the class level;

- The appropriate starting point for employers to move from the current system to the proposed preliminary Rate Framework for transition purposes; and

- The potential for a surcharge mechanism for employers with disproportionate claim costs relative to their class and/or a significant gap in reaching their Target Rate.

Actuarial Predictability

Key goals

- Fairly allocated premiums

- Balanced rate responsiveness

- Transparent & understandable

- Collective liability

As part of the proposed preliminary Rate Framework, the WSIB evaluated the merits of revising the existing experience rating programs. It was determined that the programs could be replaced with a prospective, Employer Level Premium Rate Adjustment process, as part of a Risk Adjusted Premium Rate Setting process that applies to all Schedule 1 employers.

The following sections walk employers through the Risk Adjusted Premium Rate Setting process using an illustrative example. Using a series of steps (Step A – I), the WSIB will use the risk banding process to calculate how an employer would arrive at their Employer Target or Actual Premium Rate.

Step A: Determining an Employer's Actuarial Predictability

In Step A, a medium sized employer is used to demonstrate what factors the WSIB considers when determining an employer's actuarial predictability. Employers A has an individual responsibility of 40% (0.4), and collective responsibility of 60% (0.6).

Key goals

- Fairly allocated premiums

- Balanced rate responsiveness

- Transparent & understandable

- Collective liability

- Ease of administration

Risk Banding

As part of the proposed preliminary Rate Framework, the WSIB evaluated the merits of revising the existing experience rating programs. It has determined that the programs could be replaced with a prospective, Employer Level Premium Rate Adjustment process, as part of a Risk Adjusted Premium Rate Setting process that applies to all Schedule 1 employers.

Under the proposed preliminary Rate Framework, each employer would see their Class Target Premium Rate adjusted based on the risk that the employer brings to the system (after taking into consideration each employer's historical experience or actuarial predictability). This adjustment will result in a premium rate for the upcoming calendar year that is no longer subjected to a surcharge or a rebate later in the following year.

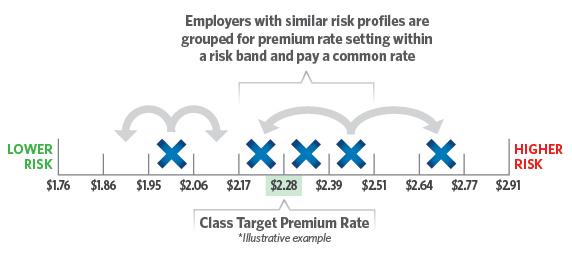

The figure below illustrates how a risk band chart could appear under the proposed preliminary Rate Framework

Risk Banding Scale

In order to determine an Employer Premium Rate Adjustment, and where they would be placed relative to the Class Target Premium Rate, the WSIB would first determine the employer's individual actuarial predictability as described in the previous section. After the employer's actuarial predictability has been identified (Step A), the WSIB would use the Steps B-I to determine the Employer Level Premium Rate for the upcoming year, and what risk band they will be in.

Risk Banding Step B – I

Using the employer example presented in Step A that discussed actuarial predictability, the following Step (B-I) shows how an employer would be risk banded, and how their Employer Target and Actual Premium Rate would be calculated. The Employer Target Premium Rate represents how much an employer would need to pay in order to fund their fair share of costs, as well as the collective costs of the class under the proposed preliminary Rate Framework.

Step B: Determining an Employer's Total Claims Cost

The WSIB would review all of the injuries that occurred over a rolling six year period. This means that for 2014 premium year, for example, the WSIB would use 2007 to 2012 injury years.

Then, the WSIB would summarize all the associated costs that have been paid for those registered claims, taking into consideration the claim limits assigned at the employer level.

Example of an Employer's Total Claims Cost Over a Six Year Period

| Six year window including claim costs from Jan 1, 2007 to Dec 31, 2012 | ||||||

|---|---|---|---|---|---|---|

| Injury year | Incurred claim costs paid by year | |||||

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | |

| 2007 | Total claim costs |

|||||

| 2008 | ||||||

| 2009 | ||||||

| 2010 | ||||||

| 2011 | ||||||

| 2012 | ||||||

Step C: Determining an Employer's Insurable Earnings

The WSIB would then obtain the insurable earnings for the same six year period (up to each year's annual maximum earnings) for each employer, as they were recorded for the reporting and payment of premiums.

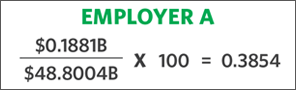

Employer A's risk profile is determined based on the claim costs that the employer paid into the system versus the earnings that were reported for that same time period.

Step D: Determining an Employer's Risk Profile

Using Step B & C, the WSIB would then determine an employer's risk profile:

Formula 1: Determining an Employer's Risk Profile

Step B/Step C x 100 = Employer's Risk Profile

Step E: Determining the Class Risk Profile

Formula 2: Determining the Class Risk Profile

Total Class Claims Cost/Total Class Insurable Earnings X 100 = Class Risk Profile

In order to compare how the employer's risk profile compares to the class risk profile, the WSIB would need to obtain the total claims costs and insurable earnings for the class of that employer.

Step F: Determining an Employer's Adjusted Risk Profile

In this step, the WSIB would need to determine how much an employer's individual claims cost/experience can be considered in undertaking the Employer Level Premium Rate Adjustments.

In order to calculate the employer's adjusted risk profile, the WSIB would multiply the employer's actuarial predictability factor (from Step A where the WSIB discussed individual and collective experience) against their risk profile (Step C) and calculate their adjusted risk profile as follows:

Formula 3: Determining an Employer's Adjusted Risk Profile

( Step A x Step D ) + [ ( 1.0 – Step A ) x Step E ] = Employer Adjusted Risk Profile

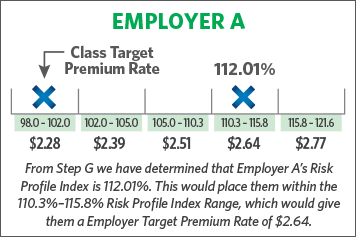

Step G: Determining an Employer's Risk Profile Index

In this step, the WSIB would assess the employer's results against the class risk profile (Step E) to determine how this employer performed versus the average of all the other employers in the same class. This calculation gives the WSIB the employer's risk profile index.

Formula 4: Determining an Employer's Risk Profile Index

Step F/Step E x 100 = Employer's Risk Profile Index

Example of Employers with Different Risk Profiles

Step H: Determining an Employer's Target Premium Rate

In order to calculate the premium rate that each employer should be paying (that is primarily based on their individual experience), the WSIB would need to determine the employer's target risk band relative to the Class Target Premium Rate, as well as the collective cost component of the class.

To do this, the WSIB would locate the employer's risk profile index on the class risk band chart and obtain the corresponding premium rate.

The outcome of this calculation would outline the Employer's Target Premium Rate. This represents what the employer should be paying based on their actuarial predictability and their individual claims experience.

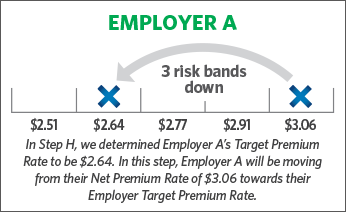

Step I: Determining an Employer's Risk Band Movement

There may be a difference (varying from a very small to a large variance) between what an employer should be paying as their Employer Target Premium Rate and what the employer is paying under the current system. Some employers (especially those who are seeing their premium rates increase) would not want to experience drastic changes in their premium rates from one year to the next to reach their Employer Target Premium Rate.

To determine what would be the "right balance" of employer movement, the WSIB evaluated a number of scenarios, including moving employers up or down:

- when employers had a premium rate change ranging from 5 to 20% relative to the performance of their class;

- when employers had a premium rate change greater than 10 to 20%; and

- by limiting the total (class and employer level) premium rate change from 10 to 20%.

The intention of this step is to gradually move an employer's Actual Premium Rate towards their Employer Target Premium Rate in a manner that would enable them to better predict their WSIB premiums from one year to the next.

New Employers

Key goals

- Fairly allocated premiums

- Transparent & understandable

- Collective liability

The proposed preliminary Rate Framework seeks to ensure that all new employers are taking part in the Risk Adjusted Premium Rate Setting process as soon as possible.

A minimum of 12 months of accident experience would be necessary to obtain sufficient information to determine the level of accident cost and insurable earnings information required to calculate an employer's risk profile, so that a premium rate relative to the Class Target Premium Rate can be calculated.

If the WSIB does not have 12 months of accident experience for an employer at the time of premium rate setting, an employer would be charged the Class Actual Premium Rate.

Surcharging Employers

Key goals

- Fairly allocated premiums

- Transparent & understandable

As part of the proposed preliminary Rate Framework, the WSIB would cap an employer's premium rates up to three times the Class Target Premium Rate. This measure would limit an employer's risk band movement each year, and protect the employer from unexpected catastrophic claim costs in a specific year.

However, there may be employers that have high and disproportionate claim costs relative to their class, year over year. Additionally, the gap between what they are actually paying in premium rates and what they should be charged may be significantly different. As such, it may make sense to assign these employers some additional accountability for their consistently poor behavior.

The proposed preliminary Rate Framework seeks to consider the application of a surcharge mechanism that would be applied against the Risk Adjusted Premium Rate Setting process.

Conclusion

The proposed preliminary Rate Framework aims to address some of the fundamental issues raised by stakeholders, partners and the WSIB itself, with the current framework and its associated business processes. The WSIB has done extensive technical analysis and modeling of design features to ensure the proposed preliminary Rate Framework is aligned with the Rate Framework's Key Goals.

The WSIB's objective is to consider reforms that ensure that everyone pays their fair share for workplace coverage, that there is a reasonable balance between premium rate stability and responsiveness, and that stakeholders can easily understand and engage in the process.

The proposed preliminary Rate Framework would allow the WSIB to allocate the distribution of costs to the system appropriately, and helps build a more equitable and modernized classification structure and Risk Adjusted Premium Rate Setting process.

The WSIB would like to hear from you! Please email us your questions or comments about the proposed preliminary Rate Framework to [email protected].

For more information, see Paper 3: The Proposed Preliminary Rate Framework (PDF)

Updated:

![EMPLOYER A (0.40 x 0.5012) or 0.2005+ [(1.0 - 0.4) x 0.3854 or 0.2312] = 0.4317](/sites/default/files/styles/inline_image/public/inline_images/p3empastepf.png?itok=7LHifSJX)