Objective

Transparent, consistent adaptable and responsive classification structure with fewer and larger groups for premium rate setting purposes, based on predominant business activity.

Alternatives for Further Discussion

- The use of business activity descriptions as a foundation for the classification of employers, and considering the inclusion of risk factors;

- Appropriate expansion and collapsing of employer groupings to meet actuarial predictability;

- Period of time (e .g . # of years) to consider earnings and claims history to determine actuarial predictability and predominant business activity; and

- The level of actuarial predictability for each employer grouping (e.g. class) for premium rate setting purposes.

North American Industry Classification System

Key goals

- Clear & consistent

- Transparent & understandable

- Collective liability

- Ease of administration

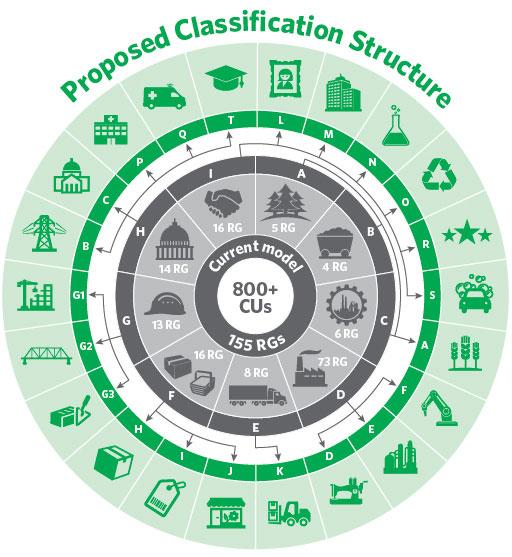

The proposed preliminary Rate Framework seeks to replace the WSIB's current employer classification system with a 22 class structure adapted from the 2012 North American Industry Classification System (NAICS), the most recent version of the NAICS. The proposed classification structure is based on significantly fewer employer groupings for the purpose of setting premium rates, compared to the current 155 RGs and 840 classification unit structure. It is intended to create a structure that is simple and understandable.

This diagram is intended to show the broad mapping of the current RGs to the preliminary Rate Framework classes. It is not intended to show where each individual employer or business activity would be assigned in the preliminary Rate Framework.

| A | Primary Resource Industries |

|---|---|

| B | Utilities |

| C | Public Administration |

| D | Food, Textile and Related Manufacturing |

| E | Resource and Related Manufacturing |

| F | Machinery and Other Manufacturing |

| G1 | Building Construction |

| G2 | Infrastructure Construction |

| G3 | Specialty Trades Construction |

| H | Wholesale Trade |

| I | General Retail |

| J | Specialized Retail and Department Stores |

| K | Transportation and Warehousing |

| L | Information and Culture |

| M | Finance |

| N | Professional, Scientific and Technical |

| O | Administrative, Waste and Remediation |

| P | Hospitals |

| Q | Health and Social Services |

| R | Leisure and Hospitality |

| S | Other Services |

| T | Education |

Key outcomes

- Clear & Consistent

- Fairly allocated premiums

- Transparent & understandable

Multiple Business Activities

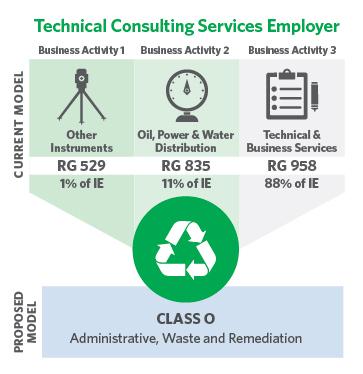

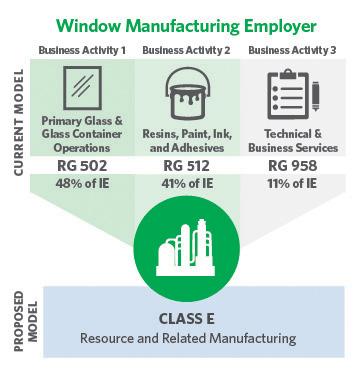

The proposed preliminary Rate Framework's proposed classification structure would group employers with multiple business activities in a single class according to their predominant class. The WSIB is proposing to define the "predominant class" as the class that represents the largest percentage of the employer's annual insurable earnings.

Classification would focus on the predominant activity - not the activities that are likely secondary for the employer that has multiple business activities classified in multiple CUs in today's scheme.

The diagrams below represent multi-rated WSIB employers, each with three business activities under the current WSIB classification scheme.

In this example, each business activity falls under three different classes in the proposed classification structure. Because the percentage of insurable earnings under RG 958 makes up the largest component of total insurable earnings (IE) (88%), it would determine the employer's predominant class. This employer's predominant class is Class O: Administrative, Waste and Remediation.

In this example, the percentage of insurable earnings under RG 502 (48%) and RG 512 (41%) both fall under the same class in the proposed classification structure. This employer's predominant class is Class E: Resources and Related Manufacturing.

Temporary Employment Agencies (TEAs)

Key goals

- Fairly allocated premiums

The proposed preliminary Rate Framework recommends that TEAs and their client employers would need to be classified in the same class in order to mitigate the premium cost avoidance issue. If this occurs, their premium rates would be similar in many cases.

TEAs are expected to pass along their premium costs to client employers as part of their fee. If TEAs and client employers have similar premium rates, there would be minimal financial incentive for client employers to use TEA workers to avoid premium costs.

To allow TEAs and client employers to be classified in the same class:

- the WSIB would seek to amend Schedule 1 of O. Reg. 175/98 under the WSIA to indicate that supply of labour to a class (regardless of what activities are performed) is considered a business activity of that class;

- and TEAs would be allowed to have a separate premium rate linked to each class they supply.

The WSIB would like to hear from you! Please email us your questions or comments about the proposed preliminary Rate Framework to [email protected].

For more information, see Paper 3: The Proposed Preliminary Rate Framework

Updated: