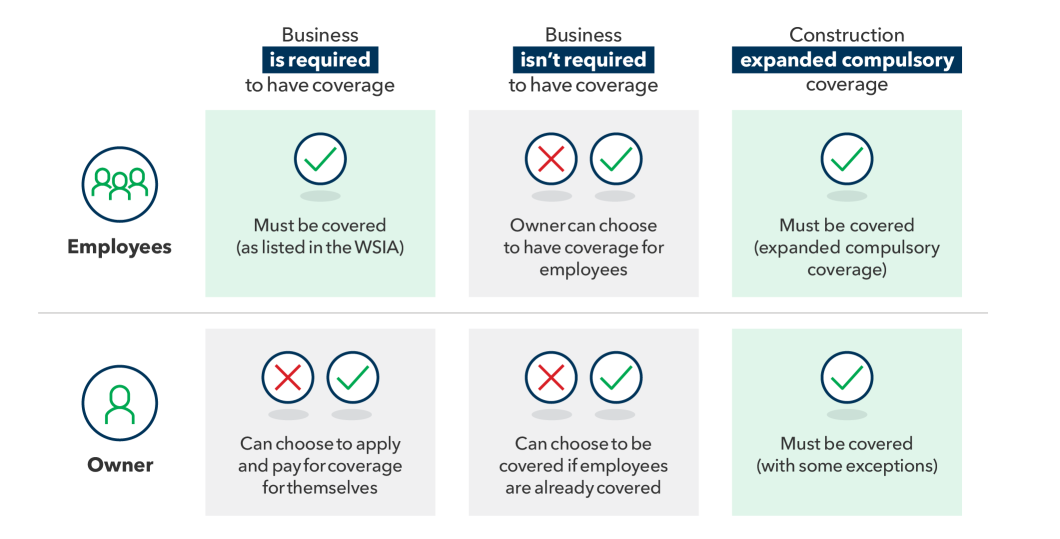

WSIB coverage isn’t mandatory for every business in Ontario. The Government of Ontario decides which industries and which types of employees have to have WSIB coverage, and lists them in the Workplace Safety and Insurance Act.

If your business isn’t required to have coverage, but you want it, you can apply for coverage for your employees.

Once your business is registered with us, your premiums cover your employees, but not owners (except for most construction businesses).

Owners (partners, sole proprietors, independent operators and executive officers) can apply for WSIB coverage for themselves, as long as they have coverage for any employees they may have (the process is the same whether your business is required to have coverage, or if you choose to have it).

Please note, WSIB coverage is the same for every business registered with us, whether your required to have coverage or choose to have it. Coverage lasts for a minimum of three months and won’t end until you cancel it.

Applying for coverage for employees

Complete the following steps if you’re not required to have WSIB coverage but want it for your employees:

- Step 1: Answer some questions about your business and your business activity, and we’ll tell you if you’re eligible to apply for WSIB coverage.

- Step 2: Click “Register now” to complete the steps to register, including providing additional information about your business such as business ownership and contacts.

Here’s a checklist with all the information you need to register.

Step 3: You’ll receive an email and a letter with information about the premium rate for your business activity and either the Employer by Application Form or Employer by Application Entertainment Industry form, depending on what industry you’re in. Please complete and sign the form and email it back to us. Your account won't be activated until we receive this form.

- Step 4: We’ll review your application form. If we have all the information we need, we’ll complete your business’s registration and activate your account. Your coverage will begin the date we receive your signed form.

- Step 5: You’ll receive a registration package by email that includes your account number and information about doing business with us. You’ll also receive a safety poster by mail that you must display in your workplace.

Applying for coverage for an owner

Follow these steps if your business has WSIB coverage and you also want it for the owners (whether they’re partners, sole proprietors, independent operators or executive officers):

- Step 1: Get coverage for your employees.

Step 2: Fill out and submit an optional insurance request/change form for each owner who would like coverage.

Step 3: We’ll review your optional insurance request or change form and if we have all of the information we need, we’ll apply coverage to the owner(s).

- Step 4: You’ll receive a letter that confirms coverage for the owner(s) and lets you know what the pro-rated premiums are for the rest of the year. This will be based on the amount you report for your insurable earnings and when in the year you applied for insurance.

Important information about the optional insurance request/change form for owners:

- Someone who has the legal authority to sign agreements on behalf of the business must sign the form.

- The form asks how much insurance you’re requesting. We recommend that you request the amount that best reflects your annual salary (which we’ll consider your insurable earnings).

- Please note, we have an annual maximum for each person’s insurable earnings – meaning you don’t have to pay premiums on anything above the annual maximum.

- We’ve developed a few best practices to help if you’re just starting out and your salary is difficult to estimate:

- For sole proprietors and partners in a new business, your annual wage can be estimated at one third (33%) of our annual maximum.

- If you’re an executive officer and have a new corporation, your insurable earnings will be set at the amount you request and won’t exceed the annual maximum.

Updated: