The Q1 2017 Report to Stakeholders shows that the first quarter of 2017 brought strong results for injured workers and strong financial results.

Some operational highlights include:

- We made eligibility decisions on 94 per cent of claims within two weeks of the claim registration date, for both Schedule 1 and Schedule 2 claims. This is well over the 90 per cent target and slightly higher than the results in the first quarter of 2016 for both groups.

- The number of injured and ill workers being treated through our integrated health care programs, such as our specialty clinics and programs of care has increased. Forty-three per cent of Schedule 1 workers received treatment through at least one of these programs, up from 41 per cent at the close of 2016.

- We implemented the first overall premium rate reduction for Schedule 1 employers. This is the first premium rate reduction since 2001.

After reaching a high of $14.2 billion in 2011, our unfunded liability has been reduced to $3.5 billion on a Sufficiency Ratio basis.

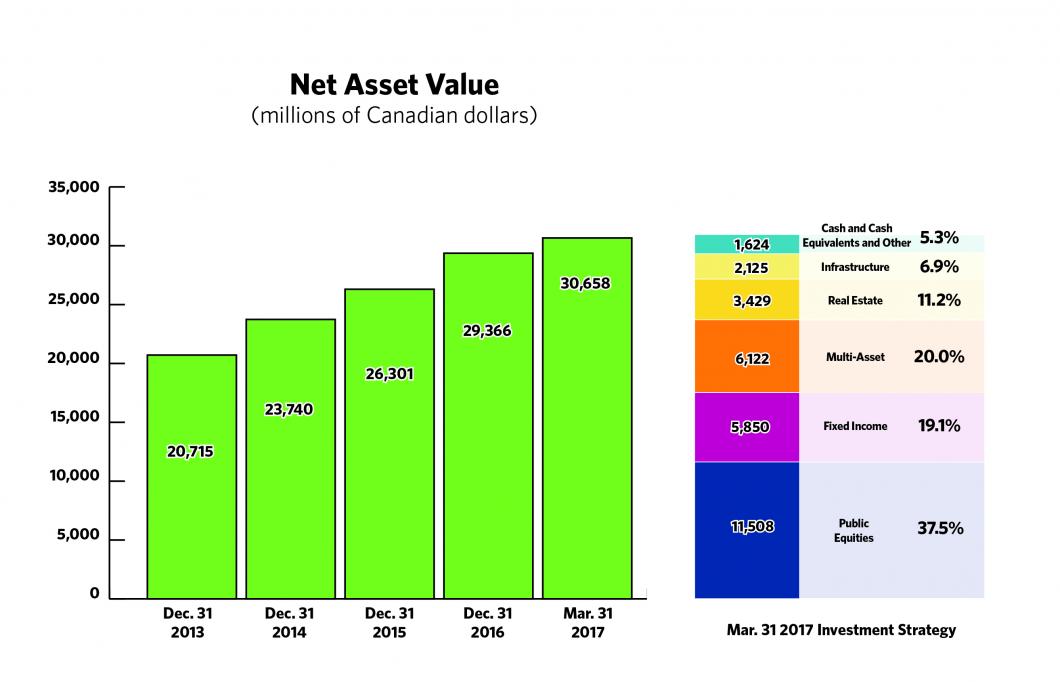

This quarter we saw an overall investment return of 3.4%, a net investment income of $896 million. Our portfolio returns were driven primarily by strong returns in public equity and multi-asset strategies.

The following chart shows our investment portfolio’s net asset value from 2013 to 2016 and the first quarter of 2017:

Read the 2017 Q1 Report to Stakeholders (PDF) to learn more about our operational and financial results.

Updated: